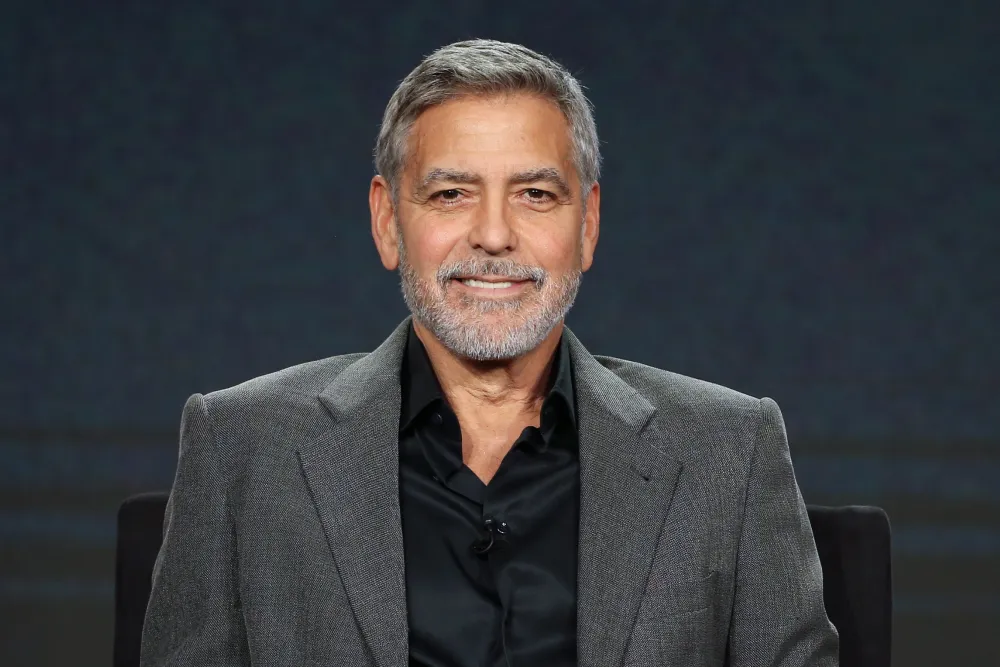

A startling incident at a June 2024 fundraiser co-hosted by George Clooney highlighted growing concerns about President Joe Biden’s cognitive health. According to a new book by CNN’s Jake Tapper and Axios’ Alex Thompson, Biden appeared confused and failed to recognize Clooney backstage. This moment, described as uncomfortable by eyewitnesses, marked one of the clearest indications of Biden’s decline. Clooney, visibly disturbed by the encounter, reportedly saw a stark change from their last meeting in December 2022.

The book, Original Sin: President Biden’s Decline, Its Cover-Up, and His Disastrous Choice to Run Again, paints a broader picture of Biden’s inconsistent but notable decline during his final year in office. Despite fluctuating energy levels, the president and his inner circle allegedly refused to publicly acknowledge his diminished capabilities. The authors assert that aides not only avoided confronting the issue but also actively tried to obscure the president’s worsening condition.

Clooney’s Op-Ed Sparks Tensions as He Urges Biden to Step Aside

Shaken by his experience at the fundraiser, Clooney later penned a widely discussed op-ed urging Biden to withdraw from the 2024 race. Though advised by former President Obama to reconsider, Clooney proceeded after consulting with Jeffrey Katzenberg and sharing the draft with Biden’s team. The op-ed included a damning comparison between Biden’s state at the fundraiser and his poor debate performance against Donald Trump. Clooney stood by the truth of his observations, despite pressure to soften his message.

Behind the scenes, Clooney’s decision ignited tensions within the Democratic establishment. Steve Ricchetti, a close Biden aide, reacted angrily to the op-ed draft, reportedly threatening to “shut Clooney down.” Katzenberg, while disagreeing with Clooney’s assessment, cautioned that the editorial might do more harm than good. Nonetheless, Clooney maintained that what he wrote was an accurate reflection of Biden’s state and the implications for his candidacy.

Bidens Defend Leadership Amid Growing Party Concerns and Public Scrutiny Over Health

In response to the growing scrutiny, both Joe and Jill Biden publicly rejected claims of decline. In a joint interview on The View, Jill Biden described the president as tireless and diligent, insisting that outsiders lacked the context to judge his performance. She emphasized his relentless work ethic and pushed back against portrayals in books written by those not present in the White House.

The Clooney incident occurred amid mounting Democratic anxiety over Biden’s fitness for office. That same night, Senate Majority Leader Chuck Schumer allegedly hinted at a contingency plan involving top Democratic leaders in case Biden faltered during the debate. Following Biden’s delayed withdrawal, high-profile figures like David Plouffe expressed frustration, blaming Biden’s prolonged candidacy for putting the party at a strategic disadvantage.